It

is

8am

on a winter morning in

Manhattan

. i-flex’s team is making a decision on whether to

accept a key negotiating point from a high profile

client. It

has taken the marketing team a lot of work to get the

client to negotiate.

At the head of the table in the

Park Avenue

office of i-flex is Rajesh Hukku, the Chairman and

Managing director. Rajesh listens to the animated

discussion for a while and then asks a lot of questions.

Finally he says firmly that he is not going to

concede the point, even if he loses the contract. He

argues persuasively that it would send the wrong message

to the market. The

meeting breaks, and the sales person, a junior employee,

is visibly disappointed. Rajesh takes him out for a

smoke, and encouragingly talks to him, smoothening his

frayed nerves. The sales person leaves happy.

is

8am

on a winter morning in

Manhattan

. i-flex’s team is making a decision on whether to

accept a key negotiating point from a high profile

client. It

has taken the marketing team a lot of work to get the

client to negotiate.

At the head of the table in the

Park Avenue

office of i-flex is Rajesh Hukku, the Chairman and

Managing director. Rajesh listens to the animated

discussion for a while and then asks a lot of questions.

Finally he says firmly that he is not going to

concede the point, even if he loses the contract. He

argues persuasively that it would send the wrong message

to the market. The

meeting breaks, and the sales person, a junior employee,

is visibly disappointed. Rajesh takes him out for a

smoke, and encouragingly talks to him, smoothening his

frayed nerves. The sales person leaves happy.

This is pure-Rajesh.

His incredibly people-oriented management style

has led him to create

India

’s most visible technology brand, a company with an

almost cult-ish loyalty, high retention rate in a

industry where two years is a long time, and a brand

that gets visibility far and above its size would

dictate. It

comes down to Rajesh’s uncanny abilities to connect to

and care for each and every rank and file employee in

the organization, and the outside world connected to it.

i-flex’s

flagship product, FLEXCUBE has been ranked the

top-selling core banking-software package by the British

International Banking System for the past two years in a

row. In

FY2004, its revenues were $185 million and profits were

$40 million. Its market share is a rich $1 billion.

i-flex: The truly

global company

A

look at Rajesh’s calendar will boggle the mind. He

logs 150,000 airmiles a year, tirelessly crisscrossing

the world from his home in

New Jersey

where he has lived for

the past eight years with his wife Smriti and two

daughters, Manisha and Manasi. He is a gold or platinum

member on almost every airline. This isn’t surprising.

i-flex has 512 customers in 105 countries, which include

little islands such as

Wanuatu

,

Malta

and

Cyprus

, to nations such as

Ireland

,

Iceland

,

Poland

,

UK

, Germany Japan,

Russia

and the

US

. Even the IMF is a

client.

His

Pilani Days

Rajesh

credits much of his success to the drive instilled by

his parents. His

parents were Professors from

Kashmir

lived in Jaipur where

Rajesh was born, before raising him in

Jodhpur

. His father inspired him

to rise to the top.

After

graduating from high school in 1974, he left for BITS

Pilani. A

few weeks later, he got a call from his father in

Jodhpur

. “You’ve gotten into

IIT Kanpur,” he said.

“Come home right away”.

Rajesh thought about it for a while.

But he was already settled into Pilani, he loved

the place, he had made new friends.

Much to his father’s surprise, he refused to

come back to join IIT.

Rajesh

loves the rivalry and constantly takes joking pot-shots

at the IITs. “The engineers from lesser known

institutes like IITs are all over the place” he joked

at the BITS Mumbai reunion.

“Its time we BITSians show them what we are

made of”.

Rajesh

loves the rivalry and constantly takes joking pot-shots

at the IITs. “The engineers from lesser known

institutes like IITs are all over the place” he joked

at the BITS Mumbai reunion.

“Its time we BITSians show them what we are

made of”.

A EEE graduate from

BITS, he was the bronze medalist of his batch at Pilani.

His name is still painted on the S-Block winner board.

Rajesh believes that his formative years in Pilani

equipped him with the people skills that guide him

today.

The Road to Entrepreneurship

After graduating from

BITS, Rajesh joined TCS in their

Bombay

office in 1979.

TCS was a small company writing code for US

companies long before IT outsourcing became fashionable.

Rajesh observed that the code TCS was writing for

American firms were being sold for substantially large

profits. He realized that though Indians were excellent

software developers, they were weak in two areas i.e.

understanding the customer’s businesses and managing

large turnkey projects.

Rajesh’s moment of

truth came in late 1980s.

Rajesh wrote software that integrated the work

done by multiple workstations at the

US

stock exchange into a

single box. This system was an instant hit and the

company was sold to Reuters for $150 million. TCS, which

had built the product, collected a few thousand dollars.

That is when Rajesh decided that someday he would build

a product instead of selling his innovative skills to

others for much less.

i-flex gets started

Rajesh was getting dissatisfied with his TCS experience.

He worked on projects in different fields and

verticals, which did not allow him to build domain

knowledge, a critical step towards a building a product.

He decided to move to Citicorp Overseas Software

Ltd. (COSL) in 1989 to focus on the financial market

vertical.

At the time, COSL was a 500-employee Citibank subsidiary containing one

product, Microbanker.

But most of its revenues were from providing IT

services to Citibank.

Microbanker was mostly ignored by COSL.

It fascinated Rajesh, because it was a core

system with capabilities to run the guts of the bank.

It wasn’t very good, but he thought it held

tremendous potential.

In 1992, Rajesh discovered that COSL was converting itself into an

internal IT shop, and had no interest in investing or

selling Microbanker to other customers. Rajesh, along

with co-founder R Ravisankar (also called Shanx) decided

they would attempt to separate the company by

spinning-off the product.

After a number of discussions within COSL, the

firm agreed. Citibank saw a lot of promise in this young

group of professionals and clearly was impressed by the

passion of Rajesh Hukku.

As part of the deal, all employees of COSL were

offered the opportunity to go to the new firm, CITIL.

150 employees accepted the offer.

Rajesh negotiated $400,000 (Rs. 1 crore at the time) in seed funding from

Citicorp Venture Capital (CVC), and named the startup

CITIL. Rajesh was named CEO. Today the employees own a

20% stake in the company.

CITIL focused on selling Microbanker to banks in

emerging market countries and did not get any business

from Citicorp in the initial years to bootstrap itself,

as COSL was doing all the work. But after a few years as

CITIL started winning Citicorp business, the stage was

set for a rivalry with the larger, better established

COSL. COSL was eventually sold to Polaris.

CITIL built a product that had global applications yet it didn’t have

the resources to brand itself.

Rajesh solved this problem by focusing his energy

at the less expensive Middle Eastern and African

markets. He made an interesting realization that even

though the economies in

Africa

were in shambles, the banks in

Africa

had money. He

leveraged the Citibank name to open doors, and the

small, relatively unknown banks sat up and listened.

As the product generated revenues, it was

gradually introduced all around the world and is firmly

established today. In 2000, the company changed its name

to i-flex, giving up the Citi prefix.

What is little known is that Citibank wasn’t the first customer for

i-flex’s products, although Citibank did buy its

services. It was actually the 47th, client,

the culmination of a three-year sales effort spearheaded

by Rajesh. Eventually

Citibank was to give the company a contract to replace

their legacy system in 100 countries.

This system will standardize 59 systems owned by

Citibank into a single FLEXCUBE system. The savings for

Citibank will far outweigh the investment.

The venture capitalists benefited hugely from this deal.

The $400,000 investment by CVC is now worth more

than $400 million. It is certainly the largest return

for any VC in

India

,

and probably the largest ever for CVC.

CVC currently owns 43.5% of i-flex.

Jim

Collins. Photo credit: Businessweek

Jim

Collins. Photo credit: Businessweek

His

Management Style

Rajesh

is a "Level 5

manager," a reference to management guru Jim

Collins' depiction. He has a very democratic style of

working and he relies heavily of building consensus in

the boardroom. He

also has a disarming sense of humor and an uncanny

ability to crack a joke and connect with people.

This style of functioning has given him an almost

cult following in i-flex and given rise to many stories

about him.

Five years ago, a newly minted MBA had just joined i-flex. The first

day, he bumped into Rajesh in the elevator leaving the

office. Rajesh promptly extended his hand and said,”

Hi! I am Rajesh. What

is your name?” The startled rookie said, “Sir my

name is ----. I

recently joined i-flex and it’s great to work for your

company”. Rajesh

smiled, “i-flex is not only my company. It’s your

company as well. We are all building this company

together”. The employee remembers that day vividly,

and is currently part of i-flex’s

Singapore

operations.

Rajesh’s

wit and deft handling of situations has many legendary

stories. One story told often is when he

was trying to convince a large European bank to replace

its crazy quilt of back-office computer software with

i-flex’s product. An executive gave him the brush-off,

telling him their company's system was so complicated,

only God could figure it out. Rajesh, in his inimitable

style, made a deft save. "Sir, we are

Indians," he said. "We are very religious, and

very close to God." Hukku won the deal.

The

Branding challenge

The

Branding challenge

By leveraging the Citibank name and by giving outstanding products and

services to customers ignored by the larger competitors,

i-flex built its marketshare.

When it became big enough, it leveraged its size

into building the brand. It wasn’t easy.

When i-flex started in 1992, there was not a

single globally recognized Indian brand in any industry,

and i-flex went through some tough times convincing its

clients about its Made-in-India products. Rajesh still

reminisces, "On many occasions, the CIO of a bank

would tell me ours was the ideal product. But the CEO

would not agree to buy it because he didn’t want to

take a risk."

All

that is history. i-flex

is one of the most widely dispersed Indian brands. Only

recently that have the likes of Vijay Mallaya of

Kingfisher, Titan and Indian pharmaceutical companies

begun to follow in his footsteps, giving their brands a

global face.

All

that is history. i-flex

is one of the most widely dispersed Indian brands. Only

recently that have the likes of Vijay Mallaya of

Kingfisher, Titan and Indian pharmaceutical companies

begun to follow in his footsteps, giving their brands a

global face.

The next challenge for i-flex is to crack the

US

market, a nation with

more banks than fast food restaurants.

(We’re only joking, but the

US

has over 8,000 different

banks). The

market potential is staggering.

Rajesh wants to utilize brand equity as the

single most effective tool for market penetration.

The Awards

Rajesh

says that the awards were missing when they needed it

the most, but as they have been successful, the awards

have flown fast. Rajesh has been awarded

India

’s highest award for

Innovation, the Dewang Mehta Award in 2003. Rajesh

donated the entire sum of Rs. 5 lakhs to the “i-flex

for child” charity program.

Rajesh

says that the awards were missing when they needed it

the most, but as they have been successful, the awards

have flown fast. Rajesh has been awarded

India

’s highest award for

Innovation, the Dewang Mehta Award in 2003. Rajesh

donated the entire sum of Rs. 5 lakhs to the “i-flex

for child” charity program.

He was named Star of Asia by BusinessWeek.

i-flex was one of the 15 survivors of the dotcom crash

profiled by the Time Magazine. Rajesh has been named one

of

India

’s top 10 movers and

shakers in the IT Industry, received the Entrepreneur of

the Year for the ICE category, and won the Emerging

Company of the Year award from ET, amongst many others

in

India

. And in October 2004,

Forbes ranked i-flex amongst the best 100 companies

‘under a billion’ in Asia Pacific adding to the long

list of accolades received by the firm.

i-flex: An amazing work place

Rajesh

lives and breathes i-flex. It

is his mission to make i-flex the role model for

innovation coming out of

India

.

His personal mission means he is on the road 15

days in a month. ‘When

he is not traveling, he is applying for visas “says

Head of Media Relations, Sunil Robert in

London

. Employee turnover till

recently had been minimal, in part due to personal

interactions of employees with Rajesh.

He has an amazing memory and can recollect little

details about his workers many years later.

Rajesh

lives and breathes i-flex. It

is his mission to make i-flex the role model for

innovation coming out of

India

.

His personal mission means he is on the road 15

days in a month. ‘When

he is not traveling, he is applying for visas “says

Head of Media Relations, Sunil Robert in

London

. Employee turnover till

recently had been minimal, in part due to personal

interactions of employees with Rajesh.

He has an amazing memory and can recollect little

details about his workers many years later.

But of late it has been hard to hold onto

i-flex employees. Known

for their technical abilities and knowledge of building

products, they are targets for companies willing to pay

significantly higher wages.

It has been reported recently that SAP and

Infosys, amongst others have been trying to poach the

product champions. But

the company refutes this. “On the base of more than

3,000 employees, a handful of people leaving was noted

and a straw case was made out of that incident”, says

Sunil Robert.

Employees return often, after they realize

the culture at i-flex is unique, they see the lack of

empowerment at other firms, and most importantly, they

don’t find employees at other firms with the same

passion and missionary zeal as their counterparts at the

firm they left. Rajesh always welcomes them back.

Rajesh, BITSAA and relaxation

Rajesh has spoken in Mumbai and

New Jersey

, and is happy to show up

at BITSAA events around the globe.

When he’s not selling software, getting visas

or inspiring students and alums, he entertains friends

and family. Rajesh is a great mimic and fan of Raj

Kapoor.

Employees

say that the early days of NASSCOM were memorable

evenings, with Dewang Mehta, a close friend of Rajesh,

an who had the same sense of humor and idea of fun as

Rajesh did, laughing, joking and partying with other

leaders of India’s IT industry. .

Employees

say that the early days of NASSCOM were memorable

evenings, with Dewang Mehta, a close friend of Rajesh,

an who had the same sense of humor and idea of fun as

Rajesh did, laughing, joking and partying with other

leaders of India’s IT industry. .

Rajesh tries to spend every free moment with

his family. He is not too concerned about improving his

golf game, “I don’t have to learn golf because if I

become good at golf, the CEOs I work with will feel

threatened. So long as I am bad at golf, they will

thrash me at it but still give me their business.” he

jokes, half seriously.

Miles to go

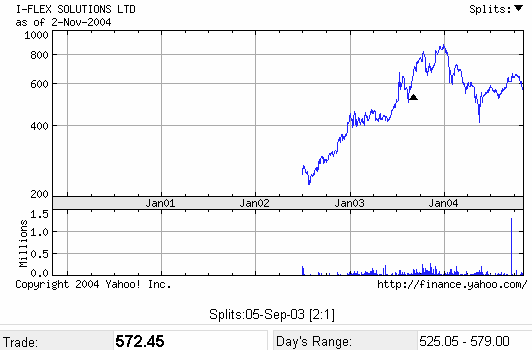

i-flex shares have risen 107% since their

IPO in June 2002. But of late, while the coding giants

are on a tear, i-flex is down 35% from its peak in

January this year.

Rajesh dismisses this as short-term myopia,

and is seldom distracted by the share price. He’s

building i-flex in the

US

and

Europe

, spending money on

acquisitions, and broadening his product offerings and

company into a diversified provider of banking and

financial solutions for the long term.

i-flex is growing rapidly.

And will hire about 1,000 professionals in the

next 5 months by March 2005.

In his view, this is only the beginning.

We believe him and are assured that Rajesh

will be collecting his 150,000 miles next year as well. ¨