| |

Private Equity and Venture Capital - A primer

By Mukul Chawla ('97 Information Systems)

The private

equity and venture capital industry has been getting much press

recently – BusinessWeek, Forbes and The Economist have all

carried articles on this sizzling industry in the past six months. And

sizzling it is – the industry controls $800B in capital

(5.5 times India’s foreign reserves), raising $174B in 2005

alone. So, what is the VCPE (as it is commonly called) industry?

Broadly, the term private equity refers to investing in a firm’s

equity privately – not via the public markets. A VCPE firm

invests in the equity of a firm, owns it for a period of time, then

sells the equity to another buyer or to the public (via an IPO),

hopefully making good on its original investment.

A rough segmentation of the industry – venture capital, growth

equity, “deep value” or late-state investing and distressed

investing – doesn’t explain all its nuances, but is a

starting point. Venture capital refers to investing in early-stage

companies, think Kleiner Perkins and fabled investments like Amazon,

Yahoo and Google. Growth equity refers to investing in growth, usually

resulting from macroeconomic factors or changes in industry structure

– discontinuities of one type or the other. Recall the $300M

Bharti Telecom investment by Warburg Pincus. Deep value investing

refers to investing in firms that are sold at prices below their

“true value”, or, in other words firms whose operational

value can be unlocked therefore creating equity value. These are often

firms that could be run better; consider the $5.1B buyout of Nieman

Marcus by Texas Pacific Group (TPG) and Warburg Pincus. Finally,

distressed investing refers to buying distressed (firms unable to pay

up their debt obligations) on the cheap, and either turning them around

or making money off their assets. Wilbur Ross may be the most notable

recent example; he has made a fortune investing in left-for-dead

business and industries in the US.

In recent times, hedge funds, which traditionally invest in the public

markets and could have a fundamentally different set of investors, have

also begun investing in private equity. An illustrative deal that has

seen much press is ESL Investments purchase of 52% of Kmart. 2005 also

saw the birth of funds that would be pursuing dual strategies (public

and private equity), a marquee launch was that of Eton Park Capital

Management founded by Eric Mindich, who had been the youngest partner

at Goldman Sachs at age 27. Not to be outdone, top tier PE funds grew

hedge fund subsidiaries, Blackstone started a $9.5B hedge fund arm and

TPG launched TPG- Axon with $2.8B in capital. This convergence between

hedge funds and private equity is very real, and was one of the most

talked-about industry trends in 2005.

Note that these segments form a continuum, essentially reflecting

stages in the evolution of a firm from startup to (perhaps) distress.

Historically, these segments of the industry began somewhat

differently. Venture capital, some would say, began with Arthur

Rock’s investment in Fairchild Semiconductor in 1957. This is a

fascinating tale of 8 scientists (dubbed the “traitorous

eight”) walking out of the legendary Shockley Semiconductor, and

seeking investment in their new venture. Rock, a visionary New York

banker visiting the west coast, met with and invested in them,

eventually helping create Silicon Valley. The invention of late-stage

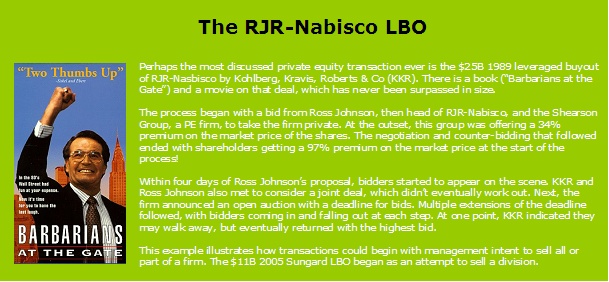

investing is less clear, but its popular techniques – including

the leveraged buyout (LBO) were known on Wall Street in the 1960s,

preceding the creation of well known speciality firms such as Kohlberg

Kravis Roberts (KKR), Forstmann, Little’ and Clayton, Dubilier

& Rice.

There are 3 ways for an investor to create value – growth,

leverage and operational improvements. (For the finance-geeks, this

would translate into revenue, WACC – Weighted Average Cost of

Capital and ROA – return on assets respectively). Investments are

made in one or more of these – VCs invest in growth for most

part, while later-stage investors often create value via a combination

of leverage and operational improvements. Roughly speaking, that

combination describes an LBO or “leveraged buyout”, where a

private equity firm buys a firm for an amount equal to a sum of (a)

capital from their own fund and (b) debt raised from the markets. The

debt is carried on the balance sheet of the acquired firm, and is paid

down through cash generated via operations.

Getting into private

equity may interest BITS Pilani graduates. You’re not alone; this

is a hot topic on most business school campuses. There is no single

path to private equity (see interview with Vivek Paul), but knowledge

of specific skills for the investing business that might help the more

recent graduate. Refer again to the segments described earlier –

skills vary by segment. The VC industry is usually interested in

operational experience (have you run anything?), so BITSians who are

either entrepreneurs or product managers (better still, have

significant P&L responsibility) could be well positioned. The VC

industry also tends to focus mostly on IT and life sciences/healthcare,

so experience in these industries helps. Growth equity requires both

strategic (to identify discontinuities and for operational value-add)

and financial acumen (to work with valuations), so firms tend to look

for former consultants and bankers. Late-stage investing is similar to

growth in its requirement, noting that banking experience is essential

at junior levels, even when you have been a consultant. Finally,

distressed investing tends to look for people who can combine financial

savvy with law, no surprise considering the legal wrangles in

bankruptcy.

There are a few other things to consider when looking for a VCPE job.

First, these firms are hugely selective, and hire very few people on an

annual basis. Second, firms tend to hire when they close funds, which

is something you can know of from trade publications. Third, the depth

of a PE market could determine the type of people – for example,

India is a relatively young PE market, so no one sector merits having

specialist professionals dedicated to that sector. Consequently, most

PE firms hire generalist consultants or bankers. In the US, where the

market is mature enough to merit industry specialists, the profile of

people at a firm tends to reflect more vertical specialization.

Further, you almost always need a business or law degree, except for

venture capital and at very senior positions, where degrees count for a

lot less. Even if you are at business or law school, VCPE firms tend

not to show up on campus for hiring, and you will need to network on

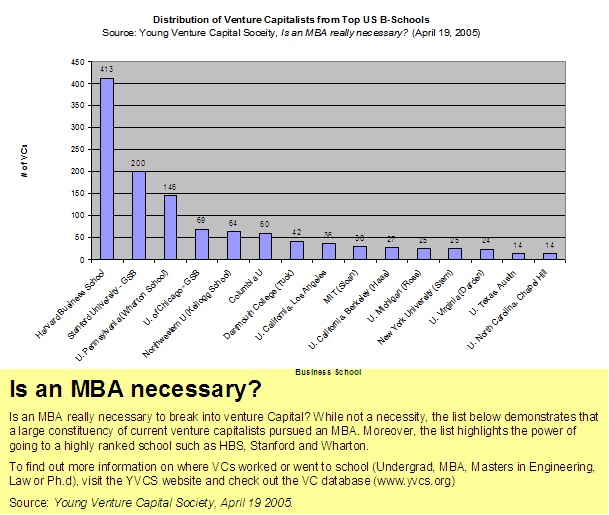

your own to find a job. Finally, some business schools have better alum

networks in the PE world; Harvard Business School is clearly the leader

when it comes to alumni in the private equity industry. Stanford and

Wharton are the other two business schools that, together with HBS,

have a large alum base in the VCPE community.

There are BITSians in

all segments of the industry, and you should reach out to them if you

are seeking a VCPE career. Many VCPE firms have very detailed websites,

spend time looking through them to understand what they do and who they

employ. Further, there are a vast variety of websites and trade

publications that can help you keep up with current state of the

industry. For an overview, there are many books you could read –

consider reading “The New Financial Capitalists”, which

traces KKR history in detail and is a good primer on the buyout

industry. On the venture side, try a subscription to Dow Jones’

Venture Capital Analyst, which has different editions for technology

and healthcare. On the web, use www.altassets.com in general, and

http://ventureintelligence.blogspot.com/ for India related VC

information. Finally, if you are at business school, you are likely to

have access to paid databases and news-services focused on VCPE (for

example, VentureXpert), use those extensively.

I will end with the same exhortation I have at the end of every message

to BITSians on the bits2bschool list. Dare mighty things in whatever

you do; stretch yourself beyond your limits, and the rest, VCPE jobs

included, will follow. Good Luck !

Mukul Chawla is a

second year MBA candidate at The Wharton School, University of

Pennsylvania and will join Warburg Pincus this fall. Earlier, Mukul was

a consultant with McKinsey & Company and held marketing and

engineering positions at Cisco Systems Inc. Mukul holds graduate and

undergraduate degrees from the University of Illinois, Urbana-Champaign

(CS’99) and BITS Pilani (IS’97) respectively. Read his

blogs at yodatma.blogspot.com. He can be reached at mukul@bitsaa.org

|